The 6 Best AI Apps for Venture Capital Firms in 2025 (Free & Paid)

The Best AI Apps for Venture Capital Firms are: Saner.AI, ChatGPT, Granola, Consensus, Gamma, and Attio

AI Tools for Venture Capital: We Tested The 6 Best AI Apps

AI is quietly reshaping how VCs find, evaluate, and manage deals.

What used to take weeks of back-and-forth emails, spreadsheets, and endless meetings can now be streamlined into minutes with the right AI tools. From surfacing promising startups to writing LP reports and automating internal knowledge, AI is quickly becoming a competitive edge in venture capital.

In this guide, we’ll explore the best AI tools for venture capital firms in 2025 - covering everything from deal sourcing to memo writing, portfolio monitoring, and beyond.

Whether you’re a solo GP, an analyst drowning in data, or a partner looking to gain leverage, this list is for you.

Why AI Matters in Venture Capital

Venture capital is fundamentally about speed, insight, and pattern recognition. In a landscape where information overload is the norm, AI helps you stay ahead.

Here’s how VC firms are using AI in 2025:

- Deal Sourcing: AI agents scan signals from Twitter, Substack, Product Hunt, GitHub, and funding databases to surface early-stage gems.

- Due Diligence: Summarizing pitch decks, company blogs, and founder interviews with tools like Consensus or ChatGPT.

- Portfolio Management: Monitor KPIs, news alerts, and financials across portfolio companies automatically.

- LP Reporting: Automate quarterly reports, generate insights, and personalize LP communication.

- Research + Market Sizing: Fast, contextual research powered by AI search engines like Perplexity, Consensus, and Saner.AI

- Internal Knowledge Base: Store all your notes, call recaps, memos, and insights in searchable, AI-powered hubs.

What to Look for in an AI Tool for VC Firms

Before choosing, evaluate AI tools based on:

- ✅ Data Coverage: Can it tap into startup databases, social signals, or news?

- 🔁 CRM Integration: Syncs with tools like Attio, Affinity, HubSpot, or Salesforce.

- ⚙️ Automation Features: Can it auto-tag, summarize, organize, or follow up?

- 🧠 Explainability: Transparent enough to trust outputs and share with LPs.

- 💸 Pricing: Fair pricing for teams or GPs - not bloated enterprise contracts.

- 📊 Custom Workflow Support: Adaptable to VC workflows like memo writing, scoring deals, sourcing, etc.

- 🔐 Compliance + Security: Especially for LP data and internal conversations.

What are the Best AI Apps for Venture Capital Firms?

The Best AI Apps for Venture Capital Firms are: Saner.AI, ChatGPT, Granola, Consensus, Gamma, and Attio

🧮 Comparison Table: Best AI Tools for VC Firms (2025)

| 🛠️ Tool | 🎯 Core Role / Use Case | 🚀 Key Features / Differentiators | 💰 Pricing & Limits | 👍 Strengths / Weaknesses | 🧑💼 Ideal For |

|---|---|---|---|---|---|

| Saner.AI | Personal knowledge + workspace hub | Natural language search, auto-tagging, multi-source sync (email, calendar, Slack), note + task integration, AI assistant (Skai), PDF summarize | - Free or $8/month | ✅ Unified “second brain” ✅ Reduces context switching ❌ Limited CRM integrations | Solo GPs, analysts, startup founders managing messy workflows |

| Granola | Meeting transcription + follow-up | Bot-free audio capture, real-time summarization, auto-highlights, post-call Q&A with AI | - Free: ~25 meetings/month - Pro: ~$10/month for unlimited | ✅ Non-intrusive (no bots) ✅ Fast recaps ❌ No speaker memory ❌ Online-only | Deal calls, quick partner syncs, founder interviews |

| Attio | CRM + deal flow + contact intelligence | Custom data model, contact enrichment, email/calendar sync, flexible pipelines, AI-assisted workflows | - Free: Up to 3 seats - Plus: ~$29/user/month - Pro: ~$59/user/month - Enterprise: ~$119/user/month | ✅ Built for early-stage VCs ✅ Customizable objects & views ❌ Workflow credits limit heavy users ❌ Pricing grows fast per seat | VC teams tracking deals, LPs, investors, and pipeline |

| Gamma | AI deck + presentation builder | Prompt-to-deck slides, import/export (PDF, PPTX), team collaboration, analytics in pro tiers | - Free: Limited cards/prompts - Plus: ~$10/month - Pro: ~$15–20/month | ✅ Fast deck generation ✅ Great for non-designers ❌ Lacks complex animations ❌ Branding in free version | LP updates, pitch decks, internal strategy decks |

| Consensus | Research intelligence engine | Pulls data from papers, blogs, expert sources Generates cited, evidence-backed answers | - No public pricing info Likely tiered (Pro/Team) | ✅ Great for due diligence ✅ Research-backed summaries ❌ Unknown pricing ❌ Gaps in niche content | Technical diligence, sector research, expert memos |

| ChatGPT (Pro) | General AI assistant for writing + research | Summarization, Q&A, brainstorming, memo writing, custom GPTs, document context | - Pro plan: $20/month (GPT-4 Turbo) | ✅ Versatile & reliable ✅ Constantly improving ❌ Prompt quality matters ❌ No real-time integrations | Analysts, GPs, platform teams—memo writing, idea gen, Q&A |

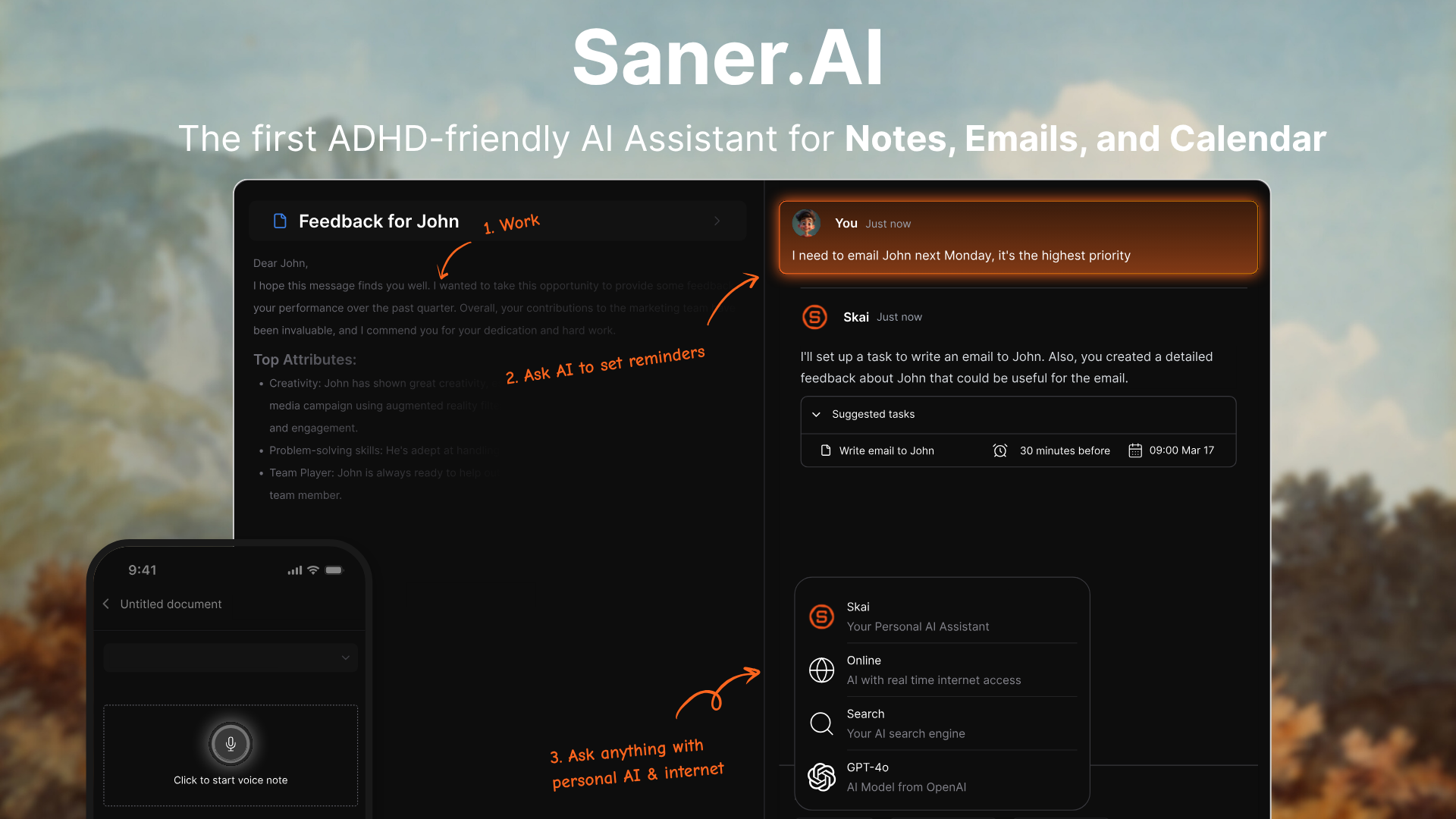

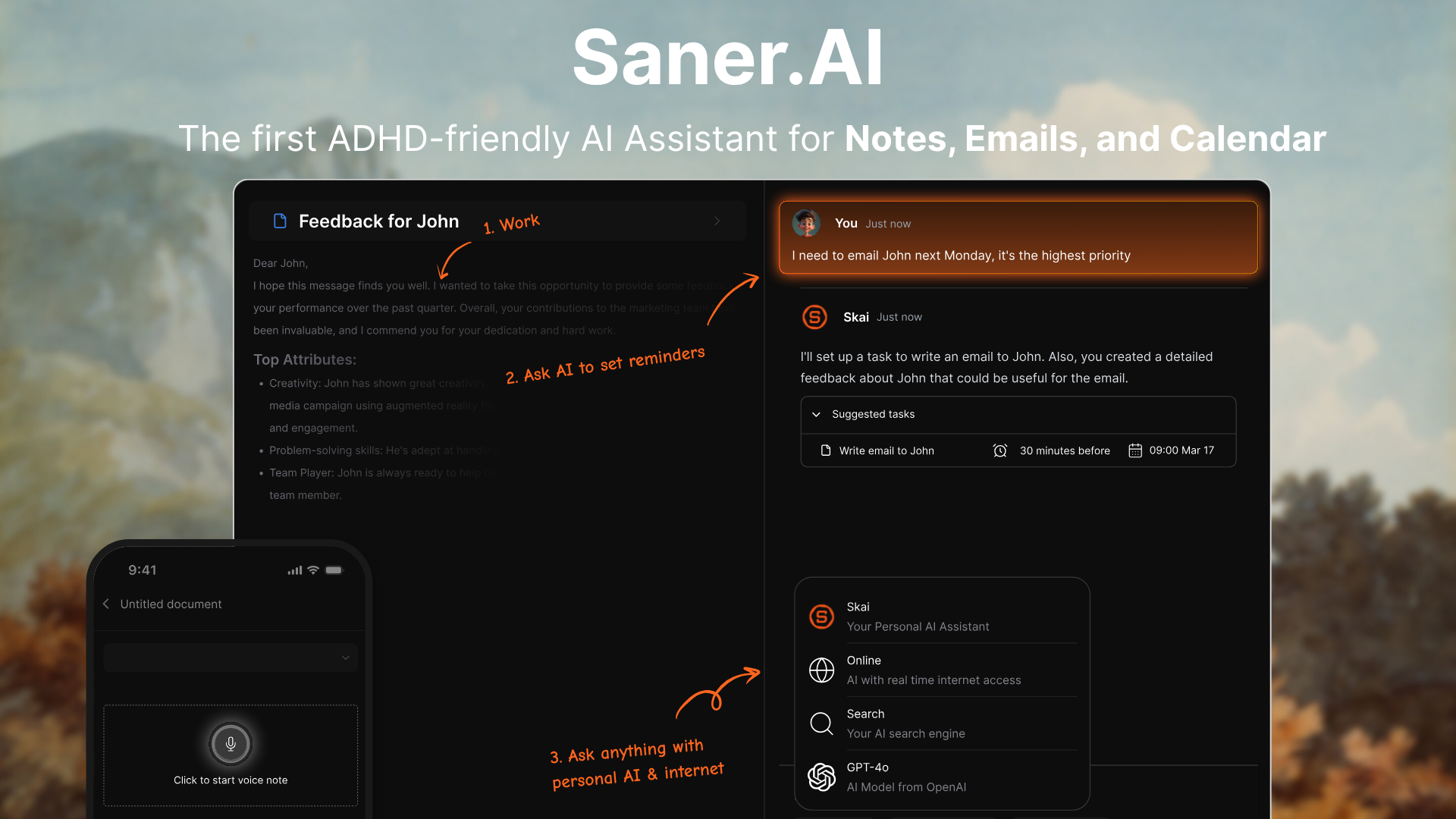

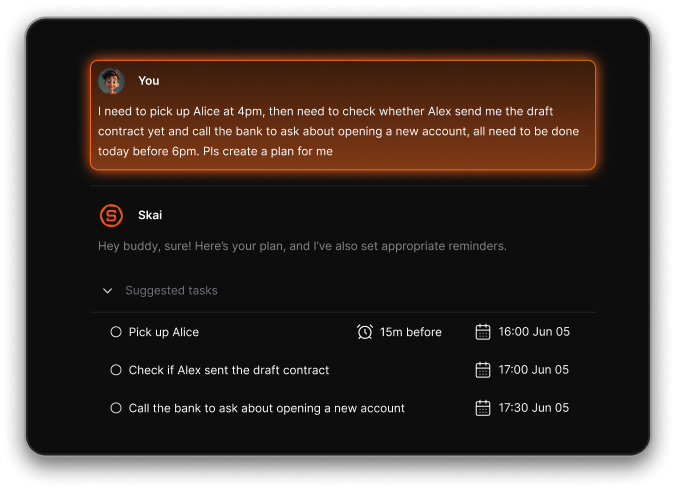

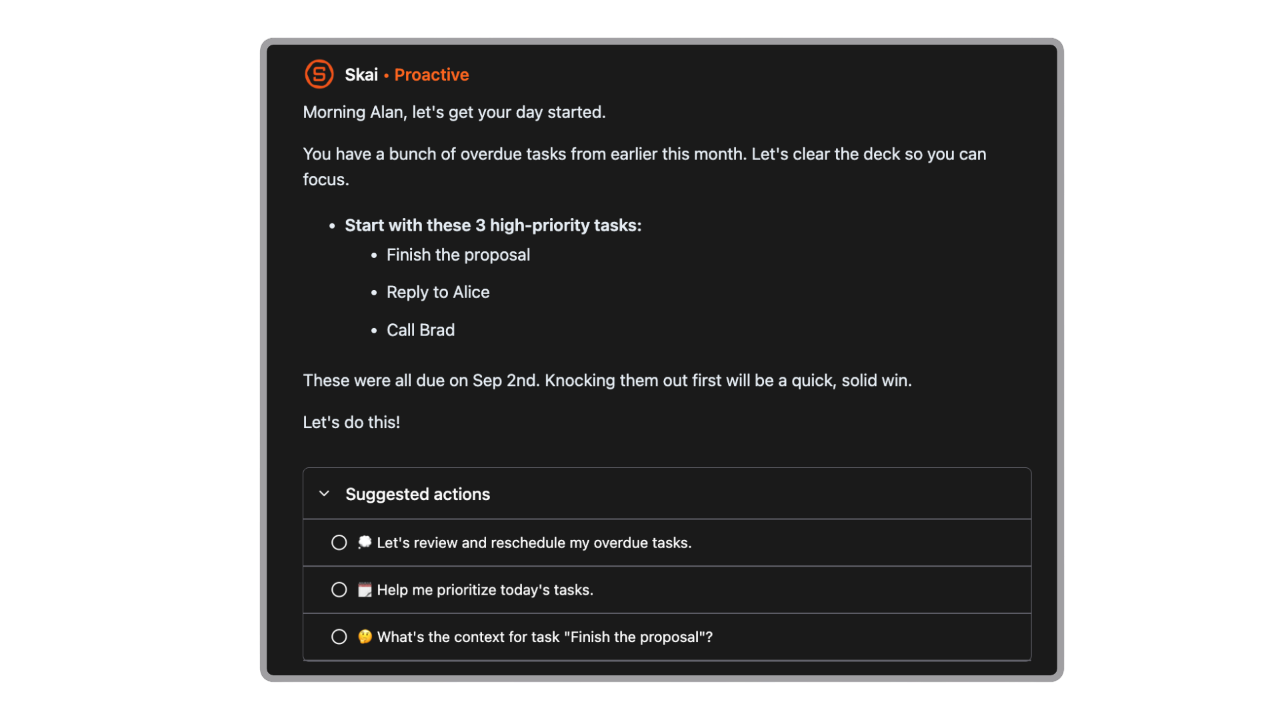

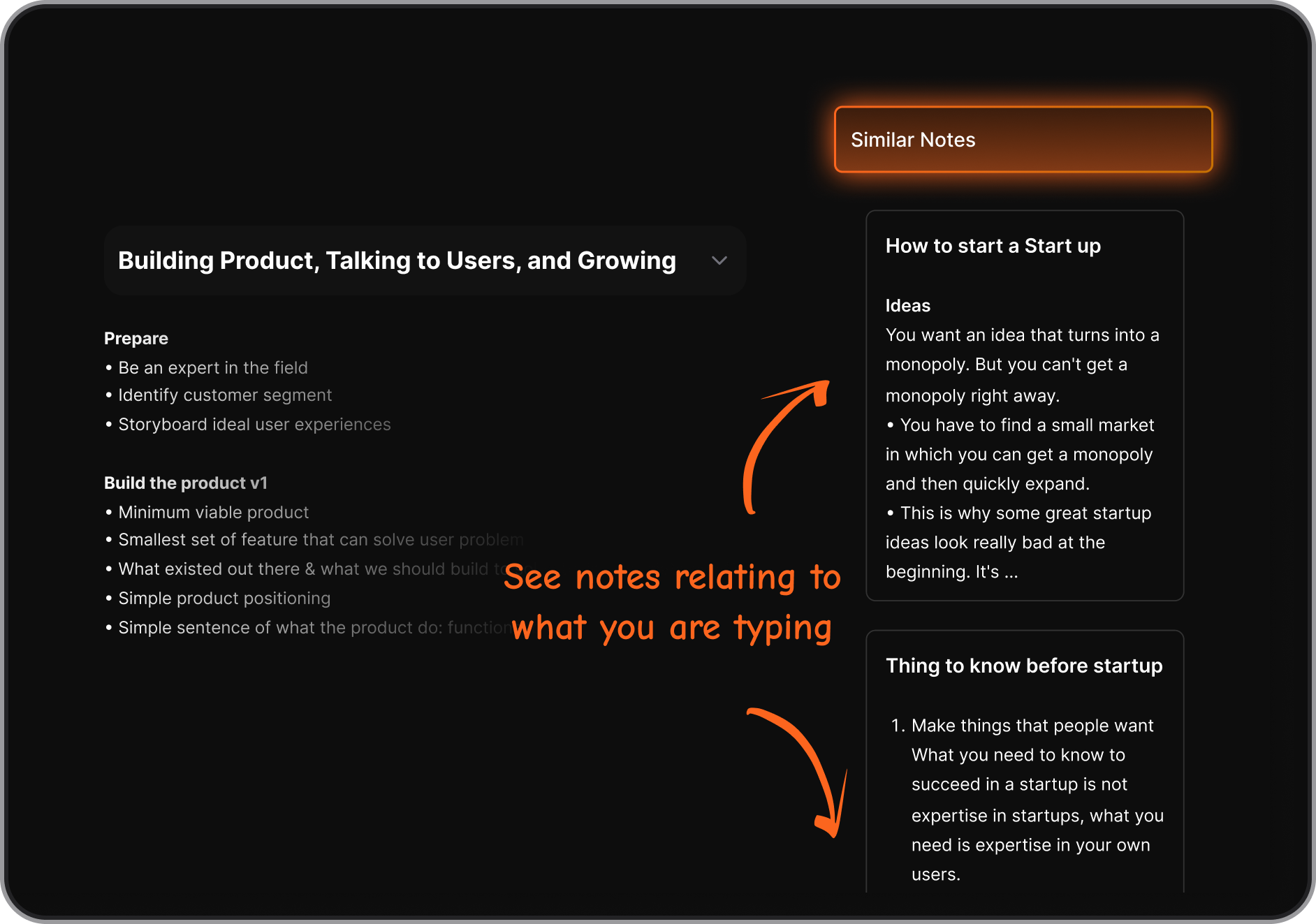

1. Saner.AI - AI Personal Assistant

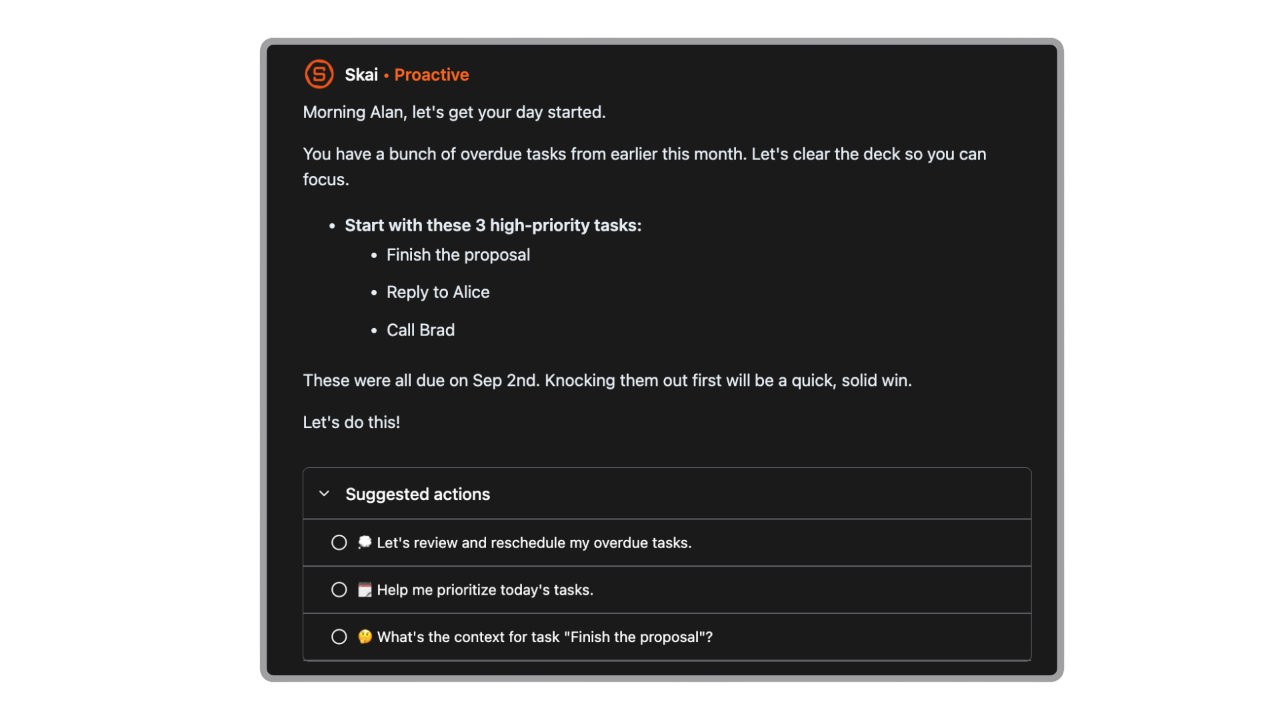

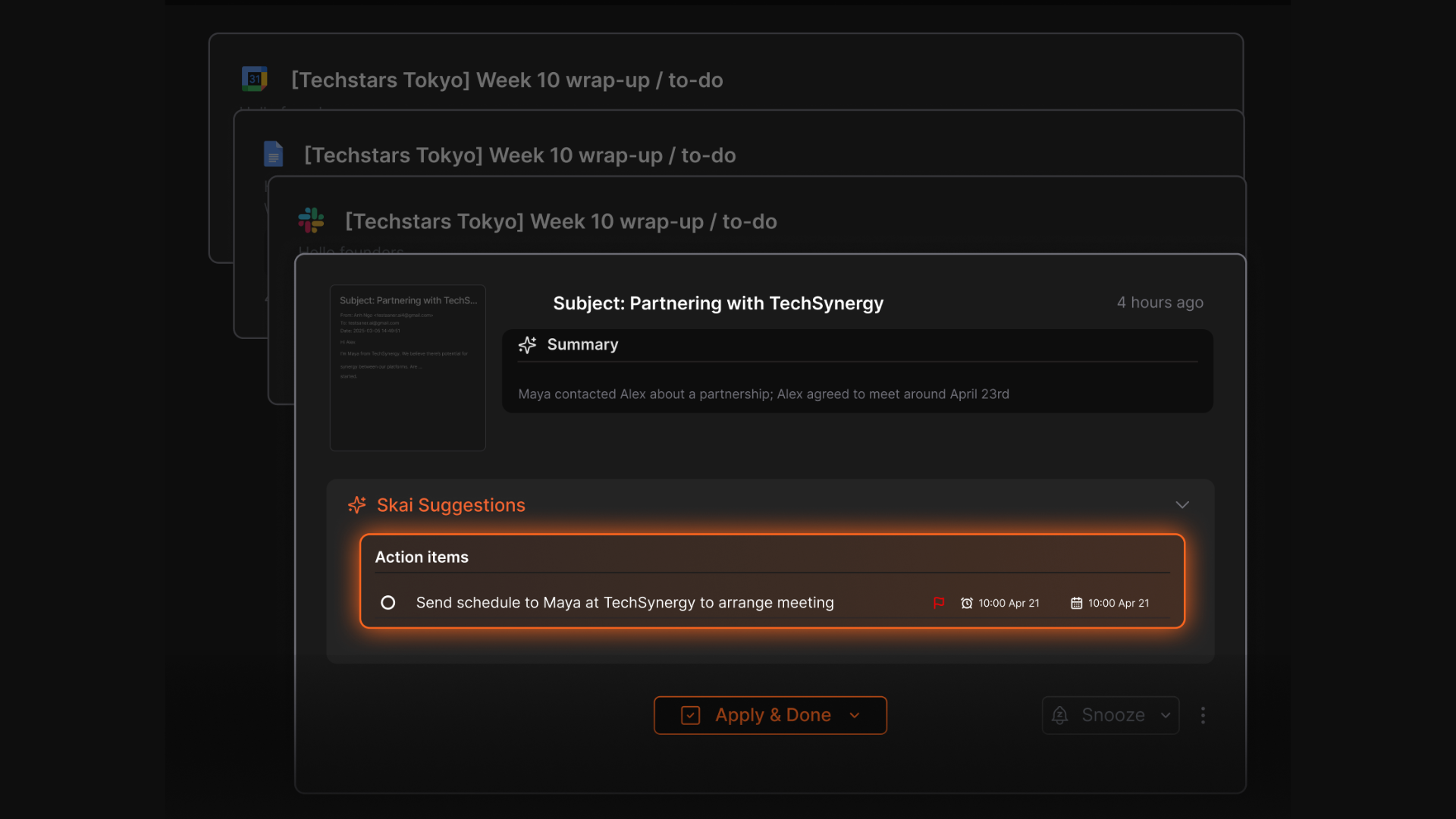

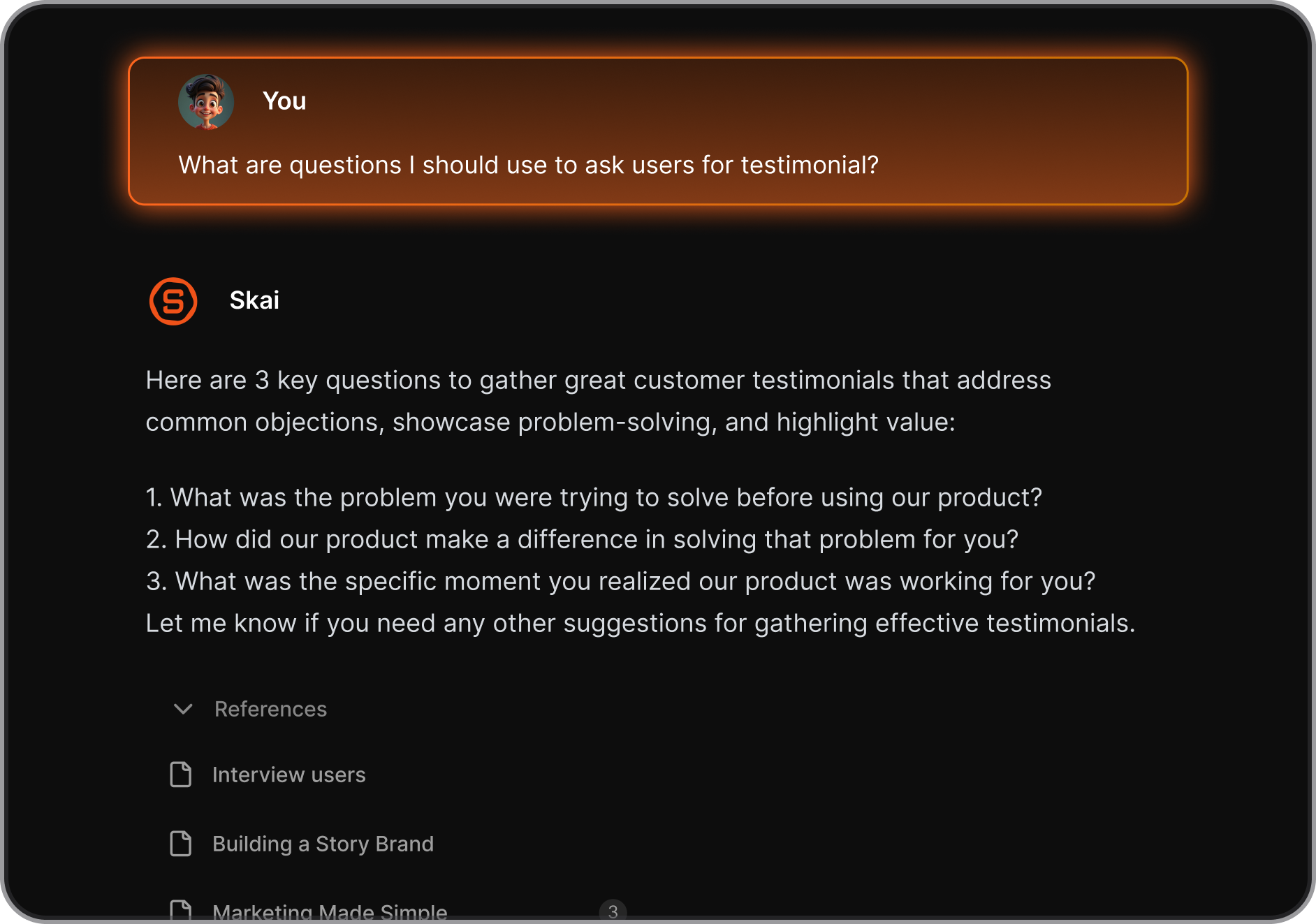

Saner.AI is an intelligent knowledge assistant that helps you organize, search, and synthesize information from your notes, documents, emails, and calendar. It acts like a personal assistant for busy investors - helping you recall past insights, surface connections between deals, and reduce the chaos of scattered information.

Key features

- Daily planning: The AI builds a simple plan for your day based on what’s urgent, due, or easy to knock out

- Task extraction: Automatically pulls to-dos from your notes, meetings, and emails

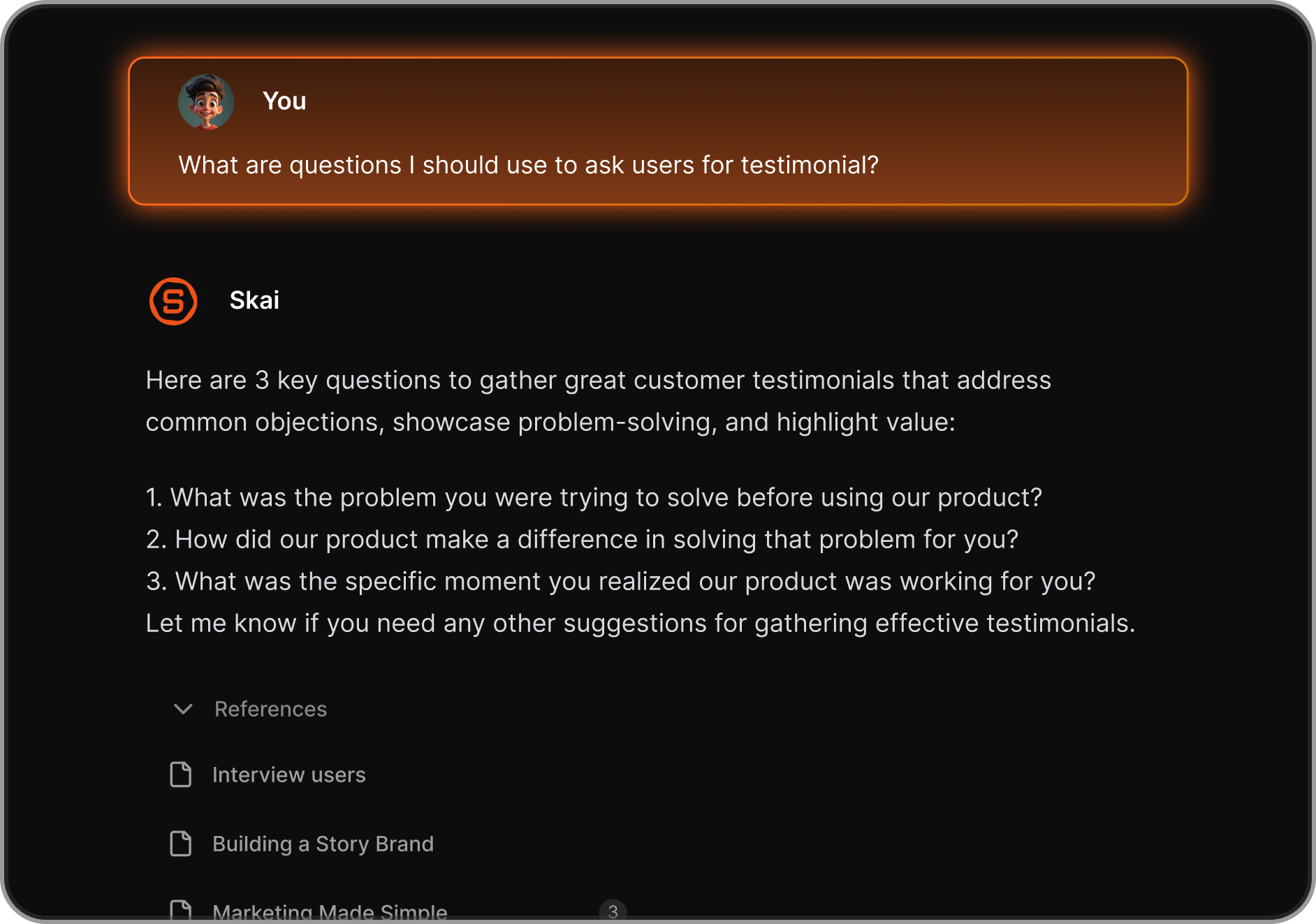

- Natural language search that lets you ask questions like “show fintech deals from last quarter”

- AI synthesis that summarizes long documents or meeting transcripts into clear insights

- Integrations with Google Drive, Slack, email, and calendar

What I liked

- You can ask Skai for help with planning your day, finding a note, or summarizing what happened

- It’s incredibly useful for connecting scattered deal data, memos, and updates across different files.

- The clean, simple design makes it easy to use without needing training.

Cons

- Not ideal for large teams or project timelines - no Gantt charts or complex task dependencies.

Pricing

- Free

- Starter: Monthly at $8/month, Annually at $6/month (with early user discount)

- Standard: Monthly at $16/month, Annually at $12/month (with early user discount)

Who is it suitable for?

- VC analysts, associates, and partners managing deal flow, founder notes, and research

- Small investment teams looking to build an internal “firm brain” without heavy setup

- Professionals who prefer a personal AI workspace for organizing complex information

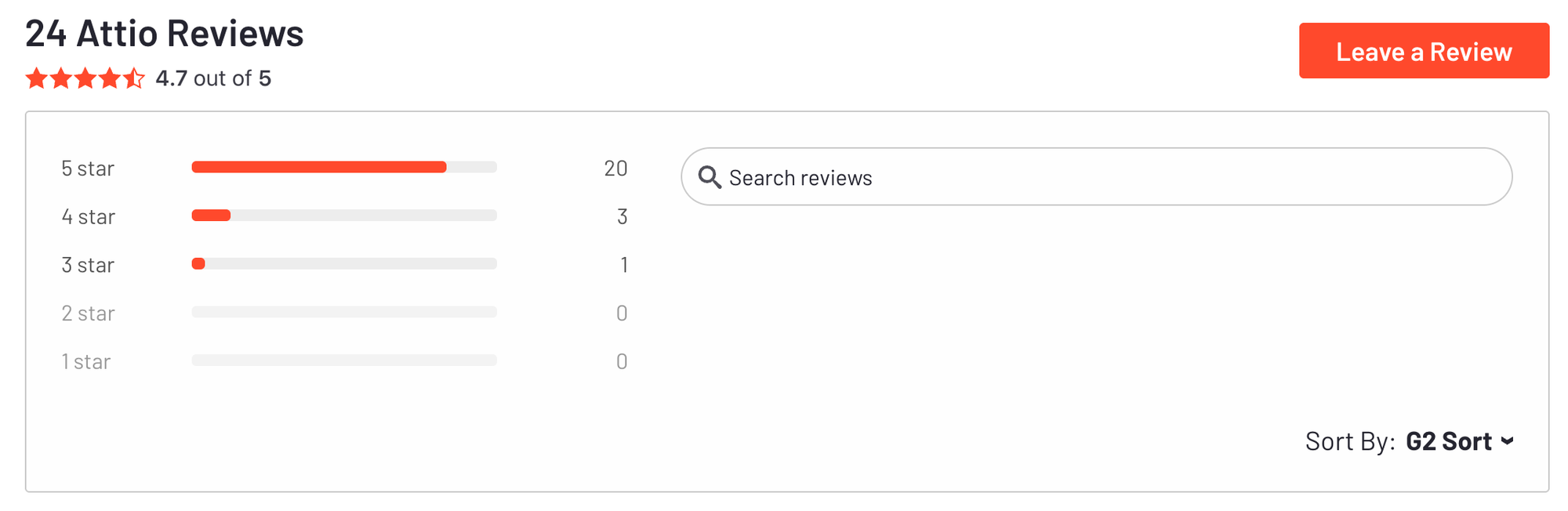

Saner.AI review

How to start using it?

- Sign up on Saner.ai, connect your files, emails, and calendar, and start chatting with the AI to summarize, organize, and recall your insights instantly

The AI Tool that works for Venture capital firms

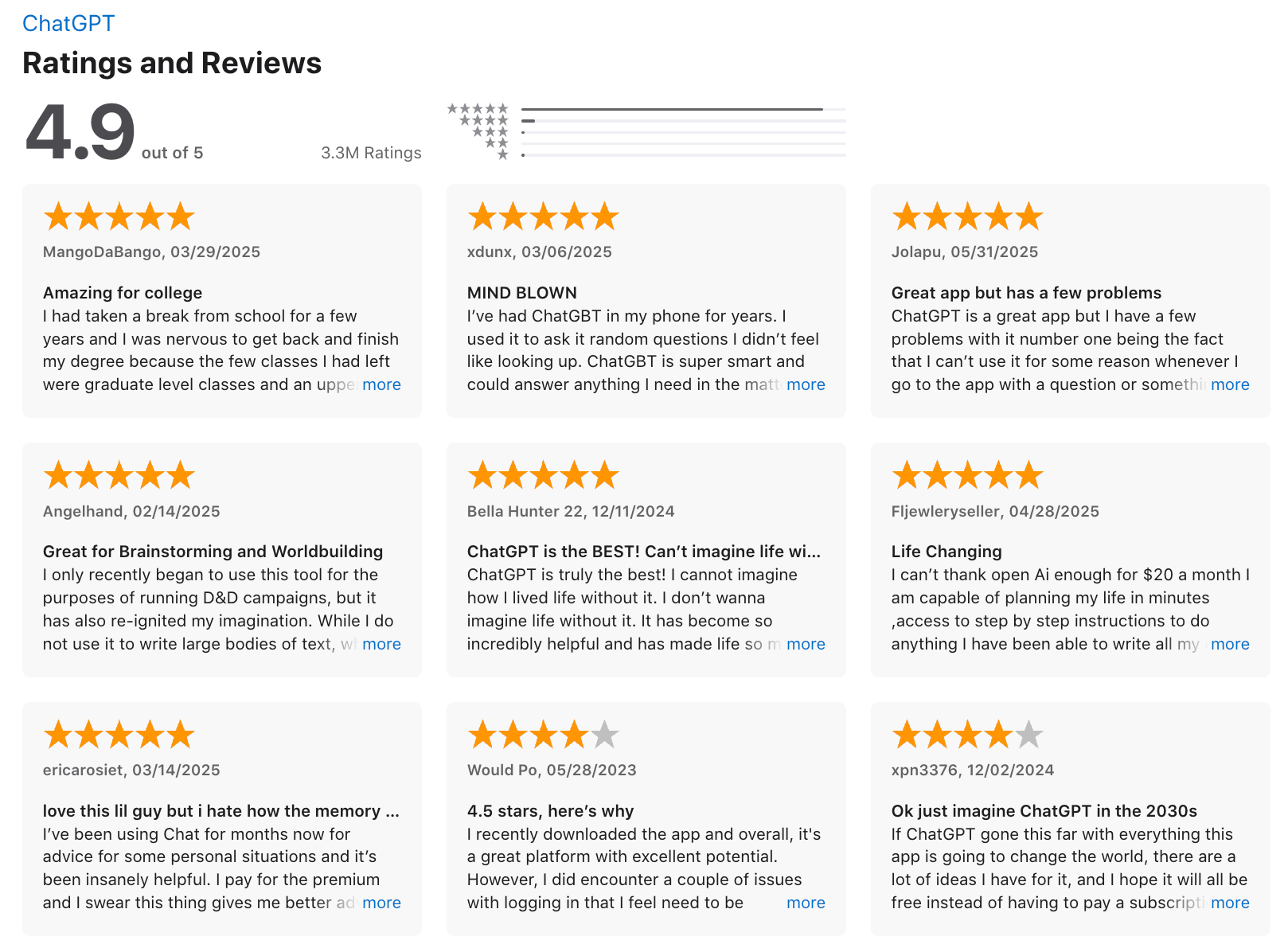

2. ChatGPT - General AI

ChatGPT is a conversational AI from OpenAI, capable of understanding and generating human-like text across domains. For venture capital firms, it can act as a research assistant, brainstorming partner, and workflow accelerator

Key features:

- Natural language understanding and generation across many industries

- Document & file analysis: you can upload files (e.g. decks, market reports) and ask questions

- “Deep Research” mode (autonomous research) for digging deeper into topics

- Wide context windows (especially in higher-tier plans) for sustaining long conversations

What I liked:

- It can quickly digest large documents or datasets, saving analyst time in preliminary screening

- The plugin/API integrations let you embed it into existing VC tech stacks

- In business/enterprise versions, you get stronger privacy safeguards, which matter for sensitive deals

- The agent's features are promising

What I disliked

- Outputs still require human validation - it can hallucinate or miss nuance in financial or domain-specific

- The free / lower tiers have stricter limits on usage, context length, or model access

- No AI assistant to manage your calendar

Pricing

- Free plan available

- Plus plan at $20/month

- Pro plan at $200/month

Suitable for

- Professionals, researchers, and businesses who want a powerful AI to help with writing, analysis, planning, automation, and real-world task execution. It’s also a great tool for developers building their own GPT workflows.

How to start

- Professionals who switch between strategy, execution, and communication throughout the day

- Anyone looking for an assistant that can analyze files, generate insights, and support creative or operational work

ChatGPT Review (source)

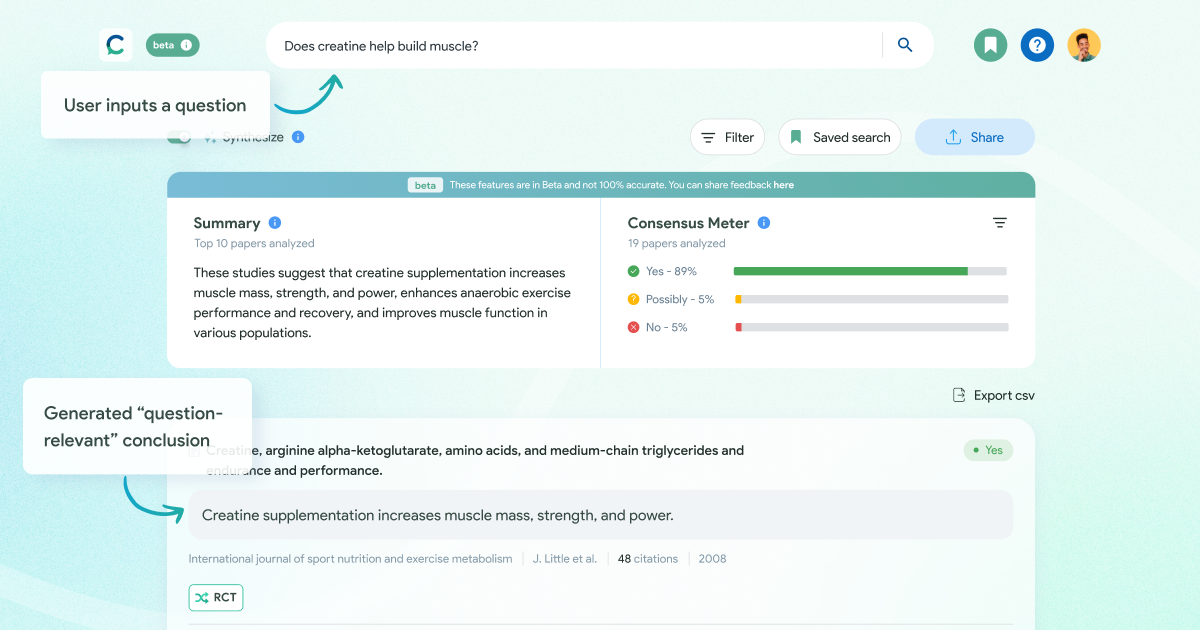

3. Consensus

Consensus is an AI research engine built to surface evidence from peer-reviewed scientific literature. It doesn’t generate content from scratch so much as it helps you find, summarize, and verify insights grounded in real studies. For VC firms, it’s interesting because it can deepen diligence, support thought leadership, and reduce time spent chasing credibility.

Key features

- Search across 200M+ scientific and technical publications

- GPT-based summaries of study findings and conclusions

- Deep search / “Pro Analyses” for complex queries

- Advanced filters by topic, date, methodology, journal

What I liked:

- It helps add rigor: using peer-reviewed sources elevates the credibility of intelligence or content generated

- It’s a faster way to check claims or market hypotheses — you don’t start from Google and hope the studies are solid

What I disliked:

- It’s not a full deal sourcing tool — you won’t get startup leads or pitch decks directly here

- Sometimes summaries oversimplify nuance or conflict in studies

Pricing:

- Free plan with basic search and summaries

- Paid plans unlock advanced filters, faster results, and higher query limits

Suitable for:

- Associates or principals who need evidence-backed insight in diligence

- Thought leadership teams who want to surface credible stats and citations

- Firms building internal intelligence tools or knowledge systems

How to start:

- Sign up for the free version at Consensus.app

- Try a few search queries in your sector of interest

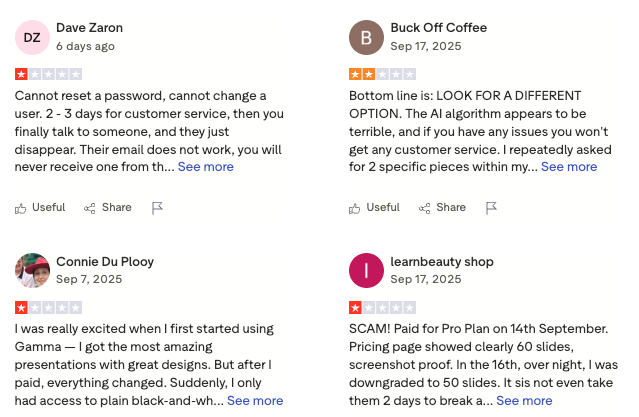

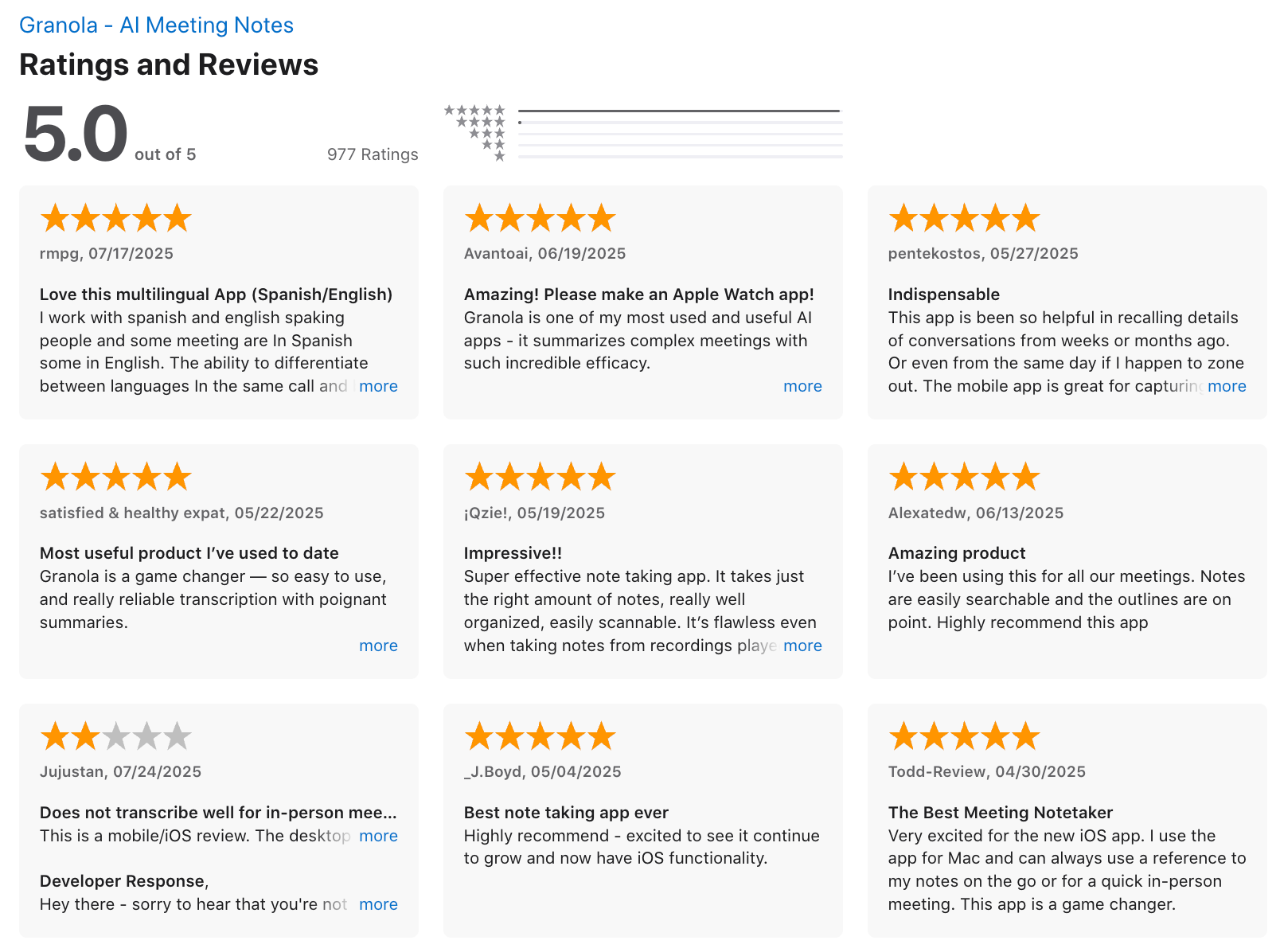

4. Gamma - AI Presentation

Gamma is an AI-powered content generation tool that transforms outlines, text, or ideas into polished presentations, documents, websites, and more. For a venture capital firm, Gamma can help speed up investor decks, internal reports, and portfolio updates by automating the design and formatting burden.

Key features

- AI generation of full decks, documents, and web pages from text input or uploaded content

- Smart layouts, automatic re-theming, responsive card-style format

- Embed charts, media, links, and interactive content

- Export options: PDF, PowerPoint, Google Slides (with some limitations)

What I liked

- You can type a prompt or paste your outline, and Gamma produces a deck fast - great for when VCs need to draft decks quickly.

- The re-theme / style switch feature is powerful

What I disliked

- The credit system can bite you - creating a full AI deck uses many credits, and the free credits don’t refresh.

- Exporting to PowerPoint or Google Slides sometimes introduces layout quirks

- It’s not an AI assistant - it won’t help you track progress or manage workflows

Pricing

- 25$/month

Suitable for

- VC firms or investors who regularly prepare pitch decks, portfolio reviews, or internal memos and want to cut design overhead

- Small teams or solo investors without access to a designer

How to start

- Go to Gamma.app (or Gamma’s website) and sign up for a free account

- Use your 400 starting credits to test AI generation

Gamma reviews (source)

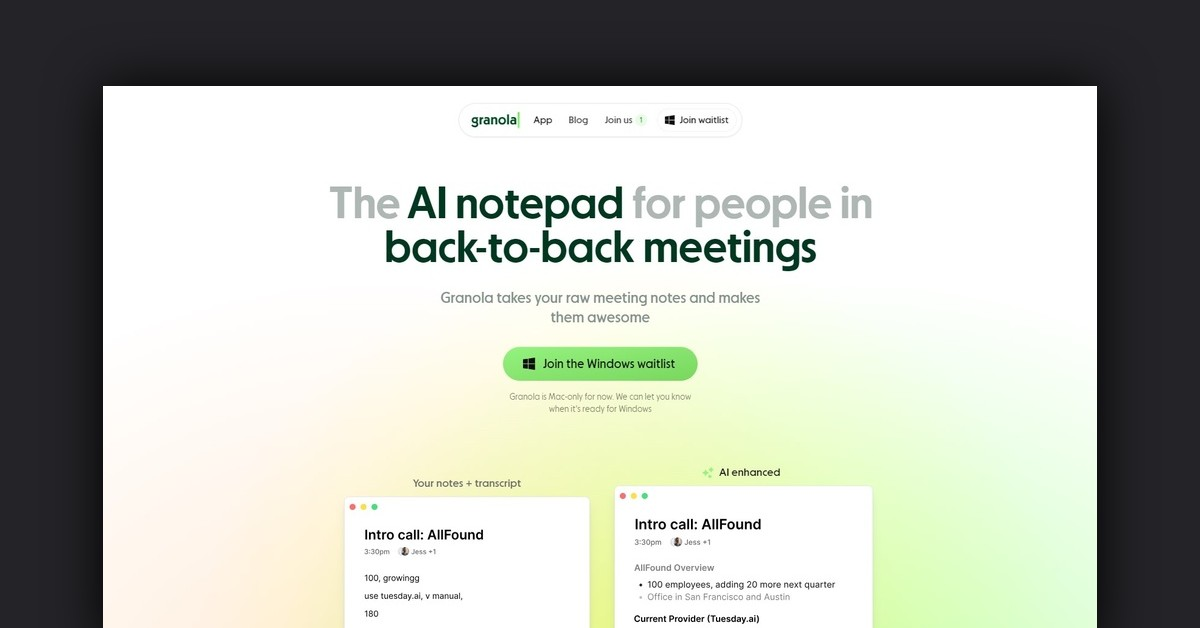

5. Granola - AI Meeting Note

Granola AI is an intelligent meeting-notepad tool with a growing reputation among VCs and startup founders. It listens in (or syncs with calendar calls), transcribes conversations, then helps you flesh out, organize, and query meeting insights.

Key features

- Automatic meeting transcription from calls (Zoom, Google Meet, Slack, Teams, WebEx)

- A hybrid human + AI workflow: you can write your own notes during meetings; Granola AI cleans up and augments them afterward

- Shared folders / team workspaces where meetings, themes, and insights are grouped

What I liked

- Having a dynamic, searchable archive of all your meetings (pitches, calls, diligence, board check-ins) is a massive productivity boost

- The balance of control is smart — you’re not fully handed over to AI; you get to nudge, correct, and add nuance

What I disliked

- No mobile or Windows app yet - Mac-only limits where you can use it

- If your firm already has strict compliance, data, or privacy requirements, you’ll need to vet how transcripts are handled

- Integrations are limited - no Asana, Notion, or Google Docs automations

- Not ideal for deep search across past meetings or long-term project tracking

Pricing

- Free trial for up to 25 meetings

- Individual plan starts at ~$10–18/month

- Team plans available from ~$14–18/user/month

Suitable for

- VC partners, associates, analysts, and investment teams who run a high volume of calls and want to squeeze more value from meetings

How to start

- Download Granola (desktop / supported platform), connect it to your calendar and meeting platforms

- Start using it on a few meetings to see how AI summaries compare to your notes

Granola review (source)

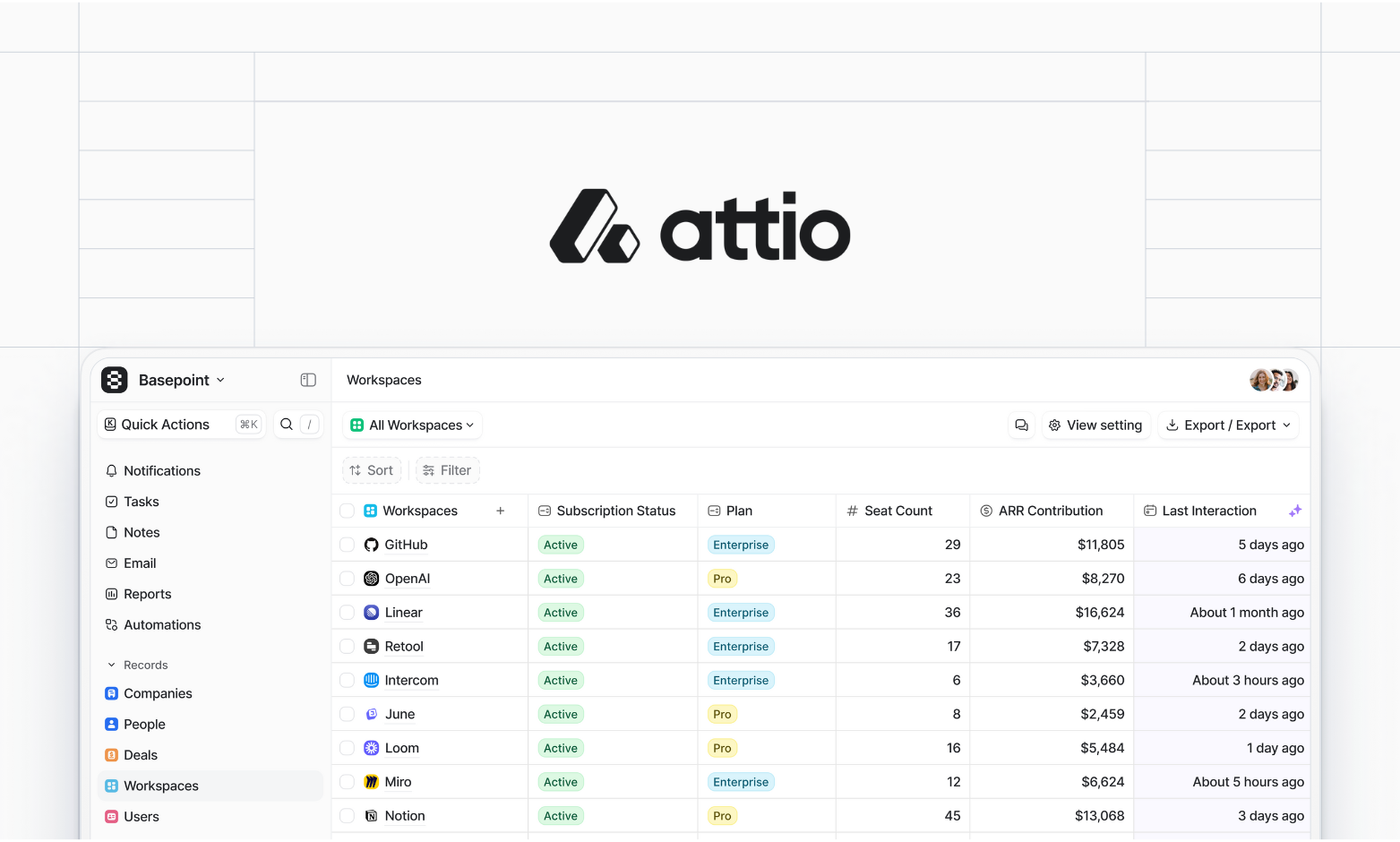

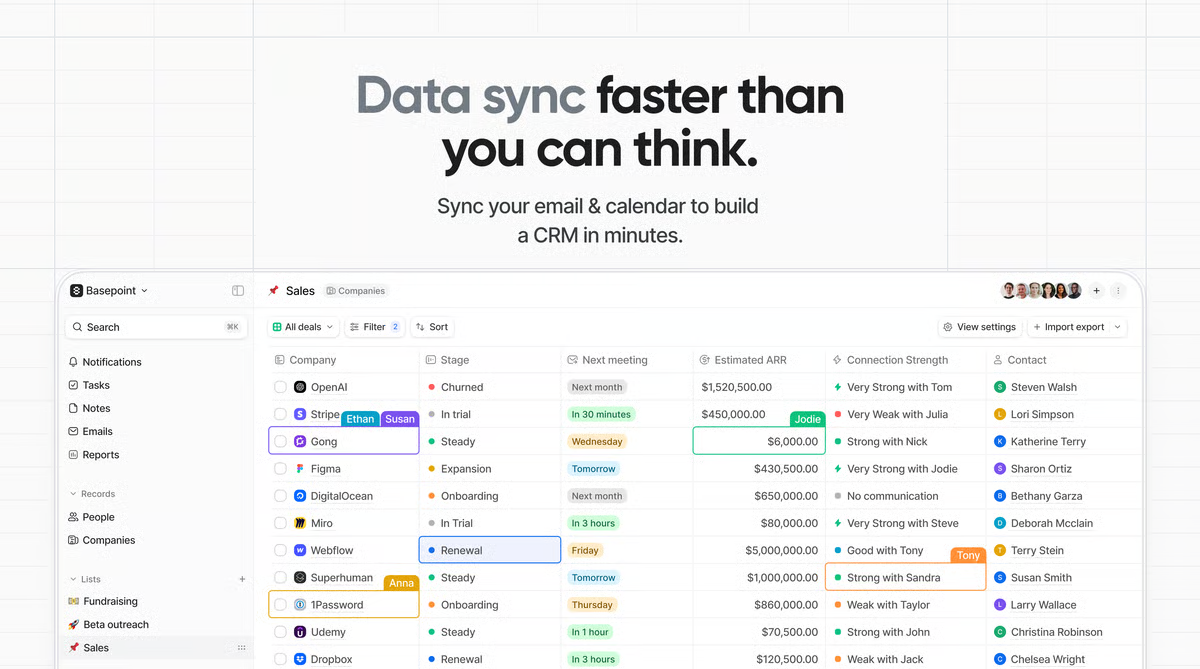

6. Attio - AI CRM

Attio is an AI-native Customer Relationship Management (CRM) platform known for its extreme flexibility and customization, often described as an "opinionated Airtable for CRM."

Key Features

- Features an AI research agent to automatically qualify leads, generate in-depth summaries, classify unstructured data, and perform complex prospecting tasks.

- Automatically syncs email and calendar data for every team member to provide a real-time, unified view of all interactions, connection strength, and relationship history.

- Provides a powerful visual workflow builder to automate repetitive tasks, synchronize data across systems, and set up complex, logic-based processes.

What I Like

- Extreme customization allows the CRM to fit the business, rather than forcing the business to fit the software.

- The clean, intuitive user interface is praised by users, making it easy to adopt (often compared favorably to Notion/Airtable).

What I Dislike

- Some advanced features, like Advanced Data Enrichment and Call Intelligence, are only available on the more expensive Pro and Enterprise plans.

- For very large, established VC/PE firms, the platform is newer compared to industry veterans, and some users have noted occasional limitations in advanced reporting or deep, specific integrations.

Pricing

- Free

- Plus: $29/user/month.

- Pro: $69/user/month

Suitable For

- Venture Capital and Private Equity

- Startups and Growing GTM Teams

How to Get Started

- Sign Up and Connect: Create a workspace and connect team members' email accounts to activate relationship intelligence and real-time syncing

Attio review (source)

Final Thoughts: The Future of Venture Capital Is Human + AI

Venture capital has always been a game of insight, speed, and judgment. In 2025, the firms that thrive aren’t the ones replacing people with AI- they’re the ones amplifying their people with AI.

Whether you’re a solo GP juggling 50 tabs or a seasoned partner trying to keep your deal team aligned, the right AI tools can help you:

- 🚀 Surface promising startups faster

- 📚 Digest research and founder decks in minutes

- 🧠 Retain context across notes, calls, and internal knowledge

- 🧾 Automate LP reporting, tasks, and follow-ups

- 🛠️ Spend less time organizing, and more time thinking

But here’s the truth: AI is only as useful as the way you use it.

The goal isn’t to automate your judgment - it’s to free up your brain to focus on what actually matters.

Start small.

Pick 1–2 tools that match your current pain points - maybe it’s Saner.AI for staying organized, or Gamma to take your pitch decks off your plate.

Then expand from there.

The future of venture capital won’t be AI vs humans.

It’ll be VCs who move faster, think deeper, and stay sharper - because they’ve built a smarter stack.

Stay on top of your work and life

🧠 FAQ: Best AI Tools for Venture Capital Firms

1. What are AI tools for venture capital firms?

AI tools for venture capital firms help investors automate research, deal sourcing, note analysis, and communication - so they can spend more time making decisions, not searching for data.

Instead of manually scanning pitch decks, financials, or emails, these tools summarize insights, predict opportunities, and streamline workflows.

Popular examples include:

- Saner.AI – an AI workspace for managing investor notes, follow-ups, and deal tasks in one place

- ChatGPT – for drafting outreach, summarizing data rooms, or brainstorming investment theses

- Granola – for turning meeting transcripts into instant summaries and action items

- Consensus – for verifying research findings and startup claims with peer-reviewed evidence

- Gamma – for creating investor decks or internal memos quickly

- Attio – for organizing deal pipelines and managing LP/portfolio relationships

2. How do venture capitalists use AI day-to-day?

AI tools are now woven into nearly every part of a VC’s workflow:

- Deal Sourcing: Use ChatGPT or Consensus to identify emerging trends or verify market data.

- Meeting Notes: Granola captures and summarizes founder calls automatically.

- Follow-Ups: Saner.AI reminds you which founders to check in with and what was discussed.

- Pipeline Management: Attio keeps contacts, intros, and deal stages organized.

- Internal Communication: Gamma turns messy notes into polished reports or decks.

Together, they cut hours of manual admin and context-switching from an investor’s week.

3. Which AI tools are best for deal sourcing and research?

If you’re focused on finding and validating new startups:

- Consensus – the go-to for evidence-based insights. It summarizes credible research papers so you can verify a startup’s scientific or market claims.

- ChatGPT – great for quick trend analysis and exploring new investment theses.

- Saner.AI – helps you connect insights from past notes, founder calls, and reports to spot patterns.

These tools together create a faster, more confident decision pipeline.

4. What’s the best AI tool for meeting and founder follow-ups?

Saner.AI and Granola are standout options.

- Granola automatically summarizes meetings and identifies next steps.

- Saner.AI connects those notes to your calendar and email, reminding you what to follow up on and when.

You’ll never lose track of who said what - or miss a crucial follow-up after a busy demo week.

5. Which AI tools help with portfolio management?

- Attio – purpose-built for relationship-driven investors, tracking every LP, founder, and co-investor touchpoint.

- Saner.AI – links meeting notes, investor updates, and reminders in one workspace so you don’t drown in fragmented CRMs.

- Gamma – turns your updates and portfolio reports into clean, shareable presentations in minutes.

These tools make portfolio communication effortless and organized.

6. What’s the best AI tool for creating pitch decks or memos?

Gamma leads the way for visual storytelling. It uses AI to generate clean, investor-ready decks or memos from plain text.

Pair it with ChatGPT for idea framing and Saner.AI to pull supporting notes or metrics you’ve collected from founders.

7. Can AI actually improve investment decisions?

Yes - when used right.

AI doesn’t replace investor intuition; it enhances it by giving you faster context, deeper insight, and fewer blind spots.

For example:

- Consensus validates startup claims using academic research.

- Saner.AI surfaces insights buried in your notes or email threads.

- ChatGPT helps model scenarios or summarize data at lightning speed.

Instead of starting from scratch, you start informed.

8. How can smaller VC firms or solo investors start using AI?

Start with simple, high-impact workflows:

- Use Granola to summarize calls automatically

- Add Saner.AI to centralize notes, tasks, and follow-ups

- Try Consensus for fact-checking startup claims

- Use ChatGPT for quick research or email drafts

You’ll see immediate time savings without needing to overhaul your tech stack.

9. Which AI tools are free or have free plans for VCs?

- Saner.AI – free plan includes note search, calendar sync, and task automation

- ChatGPT – free limited access

- Gamma – free version for deck creation

- Granola – free tier for meeting summaries

- Consensus – limited daily searches free

- Attio – offers a free tier for CRM management

It’s easy to experiment before committing.

10. What’s the most time-saving AI tool for VCs?

If you only pick one: Saner.AI.

It ties together what every investor juggles - emails, meeting notes, and follow-ups - into a single, searchable workspace.

No more “what did I promise that founder last week?” moments.

11. How will AI shape the future of venture capital?

Expect faster, more data-driven investing.

AI will:

- Flag high-potential startups earlier

- Reduce due-diligence time through research summarization

- Streamline LP reporting and portfolio updates

- Let investors focus on judgment, not paperwork

The firms already using tools like Saner.AI, Consensus, and Attio are building a measurable edge.

Become an excellent Venture Capitalist with top AI Tools